is stock trading taxable in malaysia

In Part 2 we address the basic tax implications on both the company and employee of an ESOS. While income is taxable in Malaysia capital gains on shares are not subject to tax.

Esos What You Need To Declare When Filing Your Income Tax

In the covid pandemics current scenario Malaysias Security Commission has given complete approval to the countrys cryptocurrencies operations.

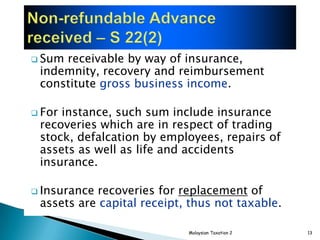

. The difference between the cost value and the market value of the auto parts is treated as taxable income of the business for the relevant year of assessment. Trading Stocks in Malaysia. However when it is frequent enough Inland Revenue Board IRB will treat it as an active income and do require income tax liability.

The RPGT will be levied on your chargeable gains. Yes its true one prominent stocks. The net profit gained from the share market is taxable if the transaction is done repeatedly.

Capital gains on shares are not taxed. Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any profits or gains deriving from any price increase when you sell a stock. This is the IRBs further clarification on the perplexing issue.

Since there is an economic crisis. Posted by JayC Mar 17 2019 826 PM Report Abuse. From a business perspective the Company has yet to dispose of the stock.

The countrys main stock exchange formerly called the Kuala Lumpur Stock Exchange became the Bursa Malaysia Exchange in 2004. This Market Taxation Guide Malaysia provides the following details. Forex trading in Malaysia is taxable and there is income tax attached to it.

In Malaysia any sale made from your investments is not subject to the capital gains tax. This is because that income is not derived from the exercising of employment in Malaysia. In Malaysia foreign exchange income is taxed as income but foreign exchange capital gains are.

However as one reader wrote in most people are of the view that capital gains from stock investing in Malaysia are not taxable a perception that is propagated on the Internet. Advantages of Investing in Bursa Malaysia. Are Forex Trading Profits xable in Malaysia.

Capital gain from stocks investment is not taxable in Malaysia but heres what you do which can cause it to be taxable. Year 2 - Claim tax deduction during filing of tax returns for year 2 Accredited angel investors must hold not more than 30 of the issued of shared capital of the investee company. Malaysia government also dont tax on.

Capital gains tax is only applicable to gains from the sale of real properties or shares in a real. Capital gains on shares are not taxed. It is not taxable in Malaysia except for gains derived from the disposal of real property or on the sale shares in a real property company.

So for example lets say you decide to purchase 1 lot of Nestle Malaysia and the share price is RM70. That means if your stocks dont have dividend you will not get tax at all for all the profits as long as you are not a US tax resident. In many developed countries capital gains tax is imposed on gains from the stock market.

All investment must be made in cash in. New and improved tax. Instructions for obtaining relief at source or a refund of withholding tax where these are available through Clearstream Banking.

It is not taxable in Malaysia except for gains derived from the disposal of real property or on the sale. The value of the s tock in trade at the end of a basis period is the same value as the stock in trade at the beginning of the following basis period. Advantages of Investing in Bursa Malaysia.

Bursa Malaysia consists of a. In Malaysia there is a tax. For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA.

Reference information about all taxes applied at source to securities deposited in Clearstream Banking 1. Individual retail investors in the stock market generally tend to invest in the stock market with the. You will require to fork out a cool RM7000 for this minimum transaction.

Claims can only be made up to the maximum of RM500000. Therefore income received from employment exercised in Singapore is not liable to tax in Malaysia. Capital gains tax is when the government imposes a tax on profits derived from any increase in price of a.

The capital gains of foreign exchange traders however are not taxed. As such the value. How Many Shares is 1 Lot.

So the gain cannot be subjected to tax payment. Investments below RM5000 are not eligible for the tax incentive. In general capital gains in the country are not subject to income tax.

Trading Stocks in Malaysia. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia. They plan to make all the trade and transactions of Bitcoins and other cryptocurrencies legal in Malaysia.

In Malaysia only income is subject to tax. Tax Advantages Capital Gains Tax Firstly there are tax advantages of investing in Bursa Malaysia. For an investor who trades with a swap-free Islamic account and does not derive an income from their trading any gains should also result in the investor not having to pay taxes on them.

However when it is frequent enough. Posted by Iamyou Mar 17 2019 824 PM Report Abuse. Dividend Yield Annual Dividend Current Stock Price x 100.

The phrase accruing in or derive from Malaysia. US only withhold tax for dividend payout from your US stocks. Yes its true one prominent stocks.

What you would need to pay is the real property gains tax RPGT. For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income.

The Company is required to account for the auto parts withdrawn from its stock. In the history of Msia no individual has been taxed on trading profits. The value of the s.

As far as I know there will be no tax if your main source of income is not coming from stock trading. As attractive and effective using ESOS may be implementing one attracts compliance and tax consequences that should not be ignored. Your capital assets are also not subject to this tax system.

In Part 1 we explored some FAQs about the basic mechanics and workings of an Employee Stock Option Scheme ESOS. There is no capital gain tax on non-resident of the US for the stock trading activities in US market. Capital gain from stocks investment is not taxable in Malaysia but heres what you do which can cause it to be taxable.

When investing in stocks in Malaysia a minimum of 1 lot is required and 1 lot is equivalent to 100 shares.

Tax And Share Trading How To Pay Tax On Shares In Malaysia Finder My

How To Trade Foreign Stocks From Malaysia Kclau Com

Acca Advanced Taxation Mys Personal Notes Chapter 1 Business Income And Taxation Of Companies Studocu

Is Forex Trading Legal In Malaysia 2022 Update

How To Trade Foreign Stocks From Malaysia Kclau Com

Is Forex Trading Legal In Malaysia 2022 Update

Corporate Tax Planning In Malaysia Tax Options Tax Position

Chapter 5 Corporate Tax Stds 2

Set Up A Limited Liability Company In Malaysia Following The 2022 Procedure

Real Property Gains Tax Part 1 Acca Global

Real Property Gains Tax Part 1 Acca Global

Is Forex Trading Legal In Malaysia 2022 Update

Corporate Tax Planning In Malaysia Tax Options Tax Position

Employee Stock Options Tax Implications Malaysia Donovan Ho

Chapter 5 Corporate Tax Stds 2

The Sun Daily Retail Investors In Shares Are Your Gains Taxable Thannees